Foreign Exchange Market: Will there be enough reserves to withstand recession?

Alexander Mukha

Summary

In 2019, private households considerably reduced their net sale of foreign exchange on the domestic market of Belarus against the backdrop of an increase in monetary incomes. Although national gold and foreign exchange reserves reached an all-time high in early 2020, they remain insufficient given the collapsing access to international capital markets for Belarusian residents. Depreciation of the national currency may further increase the risks associated with the previously accumulated external debt.

In 2020–2021, downward pressure on the exchange rate of the Belarusian ruble (BYN) and gold and foreign exchange reserves is expected to increase amid the growing large-scale economic recession caused, among other things, by the coronavirus pandemic.

Trends:

- Increased net demand for foreign exchange on the part of households and enterprises, which negatively affects the ruble exchange rate dynamics;

- Increased adverse dynamics of foreign economic operations, exacerbated by external debt liabilities;

- Increased need for external financing;

- Expected decline in monetary incomes of the population fraught with political risks.

Households and enterprises as net buyers of foreign exchange

Households continued reducing their net sale of foreign exchange in 2019 against the backdrop of an increase in monetary incomes and a decrease in unorganized foreign exchange savings of households. According to the National Bank of the Republic of Belarus (NBB), individuals sold USD 597.7 million in equivalent on a net basis1 (including cashless transactions) against USD 1.115 billion in 2018, USD 1.759 billion in 2017 and USD 1.894 billion in 2016 (see Table 1).

For comparison: over the same period, business entities sold USD 531.7 million on a net basis, non-residents – USD 571.9 million, banks and non-bank financial institutions (NBFI) – USD 705.9 million.

| Period | Net demand (–) and net supply (+) of foreign exchange | |||

|---|---|---|---|---|

| Economic entities | Population 1 | Non-residents 2 | Banks and NBFI 3 | |

| 2014 | –495.0 | –1,385.0 | 261.7 | … |

| 2015 | –403.8 | 129.6 | 227.2 | … |

| 2016 | –206.1 | 1,894.0 | 452.5 | … |

| 2017 | –880.0 | 1,759.0 | 313.9 | … |

| 2018 | –672.4 | 1,114.8 | 493.7 | 617.8 |

| 2019 | 531.7 | 597.7 | 571.9 | 705.9 |

| Jan.-Feb. 2020 | –309.4 | –172.8 | 67.8 | 186.6 |

Note. 1) Includes transactions of individuals on the foreign exchange cash market (including payment media) and non-cash transactions;

2) does not include operations performed in accordance with the Eurasian Economic Union Treaty of May 29, 2014, which regulates the procedure for crediting and distribution of import customs duties in the EEU;

3) includes spot transactions with own funds (without conversion operations), including of the Development Bank of the Republic of Belarus and non-bank financial institutions. The symbol ‘...’ means that the data was not published.

Source: author’s research based on the data provided by the National Bank of the Republic of Belarus.

The composition of net foreign exchange supply on the part of households is as follows: net sale of cash foreign exchange – USD 1.418 billion; conversion of deposits in rubles into foreign exchange deposits on a net basis – minus USD 820.1 million.

In 2019, net supply of foreign exchange on the domestic foreign exchange market totaled USD 2.407 billion, which allowed the National Bank to significantly increase national gold and foreign exchange reserves. In 2019, the reserves rose by 31.2% (USD 2.236 billion) at once to USD 9.394 billion, as of January 1, 2020, which is the all-time high in the history of independent Belarus.

However, in January-February 2020, households and enterprises acted as net buyers of foreign exchange on the domestic FX market. Households and legal entities’ demand for foreign exchange exceeded supply, which, along with other factors, negatively affected the dynamics of the exchange rate of the Belarusian ruble against major foreign currencies. In January-February 2020, households bought USD 172.8 million on a net basis (including cashless transactions), and business entities bought USD 309.4 million (see Table 1).

The transition from net sale to net purchase of foreign exchange by households stems from the following factors.

1. A significant reduction in unorganized foreign exchange savings of households over the past few years. For instance, in 2015–2019, households sold USD 8.788 billion of previously stashed cash foreign exchange on a net basis. We can expect a decrease in supply of cash foreign exchange from this source in 2020.

2. A decrease in foreign exchange receipts from labor migrants. Incomes of labor migrants employed in Russia were one of the sources of regular replenishment of unorganized foreign exchange savings of households. Belarusians prefer to take earned money from Russia back home mainly in cash. According to our forecast, an economic downturn in Russia in 2020 coupled with a sharp depreciation of the Russian ruble will lead to a further decrease in foreign exchange receipts from labor migrants employed in Russia and, accordingly, to a reduction in cash supply on the domestic foreign exchange market of Belarus.

3. An increase in demand for foreign exchange amid rising depreciation expectations. Falling oil prices and depreciation of the Russian and the Belarusian rubles hit by the COVID-19 pandemic led to increased depreciation expectations in the country and, as a result, increased demand for foreign exchange by households in 2020. From the beginning of 2020 to March 30, the official exchange rate of the Belarusian ruble against the US dollar dropped by 22.4% to BYN 2.5754/USD 1, and against the euro by 20.6% to BYN 2.8371/EUR 1 (Table 2).

| Period | Average weighted exchange rate of the Belarusian ruble against 1 | |||||

|---|---|---|---|---|---|---|

| USD | % against previous period | EUR | % against previous period | Russian ruble 2 | % against previous period | |

| 2013 | 0.8971 | 107.2 | 1.1834 | 109.8 | 2.7840 | 103.9 |

| 2014 | 1.0260 | 114.4 | 1.3220 | 111.7 | 2.6628 | 95.6 |

| 2015 | 1.6254 | 158.4 | 1.7828 | 134.9 | 2.6237 | 98.5 |

| 2016 | 1.9998 | 123.0 | 2.2010 | 123.5 | 2.9845 | 113.8 |

| 2017 | 1.9333 | 96.7 | 2.1833 | 99.2 | 3.3126 | 111.0 |

| 2018 | 2.0402 | 105.5 | 2.4008 | 110.0 | 3.2417 | 97.9 |

| 2019 | 2.0887 | 102.4 | 2.3342 | 97.2 | 3.2303 | 99.6 |

| Jan.-Feb. 2020 | 2.1618 | 100.3 3 | 2.3713 | 96.7 3 | 3.4230 | 105.4 3 |

Note. 1) Taking into account the denomination of the Belarusian ruble since July 1, 2016;

2) exchange rate of the Belarusian ruble to 100 Russian rubles;

3) % against January-February 2019.

Source: author’s research based on the data provided by the National Bank of the Republic of Belarus.

The average weighted exchange rate of the Belarusian ruble against the US dollar and the euro is likely to noticeably decrease closer to the end of 2020, as the situation on the domestic foreign exchange market is deteriorating.

4. An increase in monetary incomes of households also contributes to an increase in net demand for foreign exchange by individuals. According to the National Statistics Committee of Belarus (Belstat), real monetary incomes of households (accounting the consumer price index for commodities and services) increased in 2019 by 6.0% year on year to BYN 81.640 billion2 (Table 3).

| Period | Monetary incomes, BYN million 1 | Monetary incomes in USD terms, USD million | % against previous period | ||

|---|---|---|---|---|---|

| Monetary incomes | Real disposable monetary incomes | Monetary incomes in USD equivalent | |||

| 2013 | 44,228.6 | 49,301.4 | 137.5 | 116.3 | 128.3 |

| 2014 | 52,627.6 | 51,293.0 | 119.0 | 100.9 | 104.0 |

| 2015 | 56,289.1 | 34,631.8 | 107.0 | 94.1 | 67.5 |

| 2016 | 58,705.4 | 29,355.6 | 104.3 | 93.1 | 84.8 |

| 2017 | 64,106.9 | 33,159.3 | 109.2 | 102.8 | 113.0 |

| 2018 | 72,787.3 | 35,676.6 | 113.5 | 107.9 | 107.6 |

| 2019 2 | 81,639.9 | 39,086.5 | 112.2 | 106.0 | 109.6 |

Note: 1) taking into account the denomination of the Belarusian ruble since July 1, 2016;

2) preliminary data.

Source: author’s research based on the data provided by the National Bank of the Republic of Belarus.

According to our estimates, monetary incomes of households increased in dollar terms by USD 3.410 billion (9.6%) in 2019 to USD 39.087 billion. This calculation is based on the average rate of the Belarusian ruble against the US dollar in the domestic foreign exchange market: BYN 2.0402/USD1 in 2018; BYN 2.0887/USD 1 in 2019.

It is worth noting that households’ monetary incomes in dollar terms (USD 51.293 billion) peaked in 2014. At the end of the year, there was a local foreign exchange crisis, and the National Bank’s leadership was replaced.

The average accrued wage (except micro-organizations and small organizations without departmental subordination) increased in 2019 by 9.7% year on year from USD 476.1 to 522.3 (Table 4). The all-time high of USD 589.9 was registered in 2014.

| Period | Nominal wage, BYN 1 | Wage in USD terms, USD | % against previous period | ||

|---|---|---|---|---|---|

| Nominal wage | Real wage | Wage in USD equivalent | |||

| 2013 | 506.1 | 564.2 | 137.7 | 116.4 | 128.5 |

| 2014 | 605.2 | 589.9 | 119.6 | 101.3 | 104.6 |

| 2015 | 671.5 | 413.1 | 110.9 | 97.7 | 70.0 |

| 2016 | 722.7 | 361.4 | 107.6 | 96.2 | 87.5 |

| 2017 | 822.8 | 425.6 | 113.9 | 107.5 | 117.8 |

| 2018 | 971.4 | 476.1 | 118.1 | 112.6 | 111.9 |

| 2019 2 | 1090.9 | 522.3 | 113.3 | 107.3 | 109.7 |

| Jan.-Feb. 2020 2 | 1116.9 | 516.7 | 113.5 3 | 108.6 3 | 113.1 3 |

Note. 1) Taking into account the denomination of the Belarusian ruble since July 1, 2016;

2) without micro-organizations and small organizations without departmental subordination;

3) % against January-February 2019.

Source: author’s research based on the data provided by the National Bank of the Republic of Belarus.

Considering the economic recession in Belarus and depreciation of the Belarusian ruble against the US dollar, we can expect a decrease in households’ monetary incomes and the average wage in dollar terms, which can lead to increased social unrest and political risks as the presidential election is approaching.

Oil and gas factor

Enterprises turn from being net sellers to net buyers of foreign exchange due to negative trends in foreign economic operations, while the tight schedule of payments on foreign debt stands. The decrease in foreign exchange earnings was primarily due to a decrease in the export of Belarusian oil products and crude oil in monetary terms as a result of the fall of global oil prices and the physical volumes of exported oil products against the backdrop of protracted negotiations with Russia on oil supplies to Belarus.

According to Belstat, the average price of Russian oil for Belarus in 2019 stood at USD 365.6 per ton. The Russian Federal Service for State Statistics (Rosstat) reported the average price of Russian oil for countries outside the CIS at USD 460.7 per ton.3 The ratio of the prices of Russian oil for Belarus and countries outside the CIS increased to 79.4% from 74.0% in 2018 and 46.4% in 2014.

A similar trend is observed in gas supplies. According to Belstat, the average price of Russian natural gas for Belarus stood at USD 130.2 per 1,000 cubic meters in 2019. Rosstat reported the average export price for all countries at USD 189.3. The ratio of the prices for Belarus and all states increased to 68.8% from 59.4% in 2018.

The year 2020 may see a further increase in this price ratio, since Belarus failed to negotiate a lower gas price in talks with Russia, while the price of Russian natural gas for foreign countries was reduced. According to Belstat, in January 2020, the average price of Russian gas for Belarus was set at USD 130 per 1,000 m3. On March 25, 2020, the price of natural gas with its delivery 1 month in advance at the Dutch Title Transfer Facility hub dropped to USD 86. European countries thus had the largest ever gas inventories. Besides, demand for gas is likely to decline due to the COVID-19 pandemic.

Repayment of external debt as a big challenge

As households and legal entities’ net demand for foreign exchange increased, the National Bank had to intervene to maintain the exchange rate of the Belarusian ruble by selling FX on the Belarusian Currency and Stock Exchange, which, coupled with the repayment of a considerable part of the foreign debt in January-February 2020 led to a decrease in gold and FX reserves by 6.3% (by USD 588.7 million) to USD 8.805 billion as of March 1, 2020.

The conditions for refinancing the foreign debt of Belarusian residents worsened due to the instability in international financial markets, which, inter alia, caused an increase in the yield on Eurobonds of Belarusian issuers (the government and the Development Bank of the Republic of Belarus). The yield on sovereign Eurobonds of Belarus maturing in 2030 increased from 4.9% as of February 21 to 8.3% as of March 25, 2020.

In March, the Belarusian government had to postpone the placement of a new issue of sovereign Eurobonds. In this situation, the repayment of foreign debt will further reduce national gold foreign exchange reserves.

Given the recent developments, the repayment and servicing of the foreign and domestic debts denominated in foreign exchange is a serious challenge for all residents of Belarus. Depreciation of the national currency can aggravate the risks associated with the accumulated external debt of Belarusian residents (the government, National Bank, banking sector and enterprises).

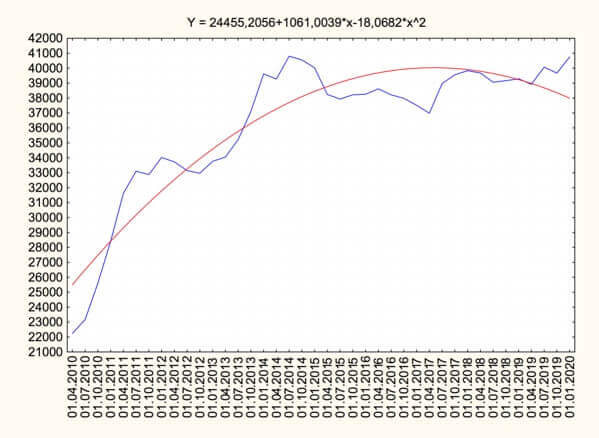

According to the National Bank, the total external debt of Belarusian residents increased in 2019 by USD 1.462 billion (3.7%) to USD 40.750 billion as of January 1, 2020, which is 64.5% of the country’s GDP (Figure 1). The external debt of Belarusian residents is still over the economic security threshold set at 60% of GDP.

The schedule of forthcoming payments on the gross external debt of residents of Belarus as of January 1, 2020 includes payments on the principal debt and interest, a total of USD 47.922 billion.

Payments by residents of Belarus on the external debt in 2020 are estimated at USD 18.455 billion (including debt refinancing operations). Belarus’ gold and foreign exchange reserves totaled USD 9.394 billion as of January 1, 2020, and, despite the historical maximum, only covered 50.9% of the upcoming payments on the foreign debt. According to the Guidotti criterion, gold and foreign exchange reserves should cover 100% of upcoming annual payments on the total external debt of the government, central bank, enterprises and banks.

Conclusion

Belarus is entering into difficult times, being influenced, among other things, by the COVID-19 pandemic, which breaks production and trade chains, and may lead to a larger decrease in demand for Belarusian commodities and services and foreign exchange receipts of the country with all the consequences that come with this. Besides, it is possible that the global economic crisis of 2020–2021 will be heavier than that of 2008.

Given the deteriorated access to international financial markets, the current size of the national gold and foreign exchange reserves is not sufficient to withstand the impending recession. Therefore, from the point of view of countering external shocks, Belarus should step up negotiations with leading international financial institutions to raise extra funds for its economy.