Mass Media: Seeming calmness amid accumulating threats

Еlena Artiomenkо

Summary

The 2nd European Games, parliamentary elections, disputes with Russia over oil and gas supplies and integration roadmaps were the major news topics for the mass media of Belarus in 2019. Media managers were expected to cope with somewhat opposite tasks. On the one hand, they were to help ‘save face’ and build an image of Belarus as an open and free country primarily for Western observers and guests. The authorities even reduced pressure on independent media to this end. On the other hand, media were tasked to ensure and strengthen their influence on information consumers, among other things under increasing external media pressure from the East.

Trends:

- Alleviated government pressure on independent media outlets;

- Patchy and inadequate measures to strengthen information security;

- Domination of the Internet over television in terms of the share of the advertising market;

- Deficient research of both traditional and online media audience and shallow analysis of the findings.

Media in the context of major nationwide events

The government used the 2nd European Games held on June 21–30, 2019 in Minsk and the parliamentary elections of November 17 to present Belarus well as an open and free country, although the domestic political traditions did not change, and neither did the tools used to ensure the desired outcome of the elections. A simple and painless way – easing pressure on independent media-was chosen.

The trial of Tut.by Editor-in-Chief Marina Zolotova in the so-called “BelTA case”1 on March 4, 2019 was a high-profile event. M. Zolotova was found guilty of negligence in office, and, according to experts, was punished rather mildly. She was fined BYN 7,650 (around USD 3,800).

Experts of the Belarusian Association of Journalists (BAJ) wrote in the Media in Belarus monitoring report that not a single independent journalist, who cooperated with foreign media, was officially fined during the 2nd European Games in Minsk from late May to late July 2019, although fines have been widely used in Belarus as a tool of pressure (38 cases January through May 2019).2

Independent collaborators with foreign media continued to be fined after the end of the European Games. Nevertheless, the 2019 parliamentary elections were generally incident-free, and repressions against independent media did not grow severe. However, independent media showed little interest in the election campaign since opposition politicians were basically inactive.

Information security enhancement measures

The task to demonstrate relative freedom and openness of Belarus was fulfilled quite successfully, but the Belarusian authorities have not succeeded as much when addressing the second strategic task to ensure information security in the face of rising challenges, first of all the past parliamentary campaign and the future presidential election in 2020, as well as the difficult negotiations with Russia on compensation for damages caused by the supply of contaminated Russian oil through the Druzhba pipeline in April 2019 and the tax maneuver in the Russian oil industry. The work on roadmaps for integration with Russia added fuel to the fire as well.

The government has been thinking hard about enhancing information security for a few years now. Spending on state media was significantly increased in 2019. Earlier, efforts were made to take the Internet under state control.

In August, when appointing Andrei Kuntsevich deputy presidential chief of staff in charge of ideology and media, Alexander Lukashenko pointed at the key media policy issues: the youth and Internet audience outreach.3 The young official with a journalistic background was appointed particularly to deal with these issues.

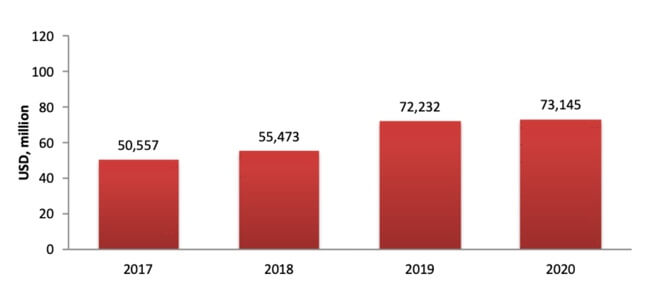

According to the Belarusian Association of Journalists, public spending on media support increased in 2019 by 30% in U.S. dollar terms.4 The amount of state support will not change in 2020, standing at USD 73.145 million (USD 72.232 million in 2019) (Diagram 1).

Source: Belarusian Association of Journalists.

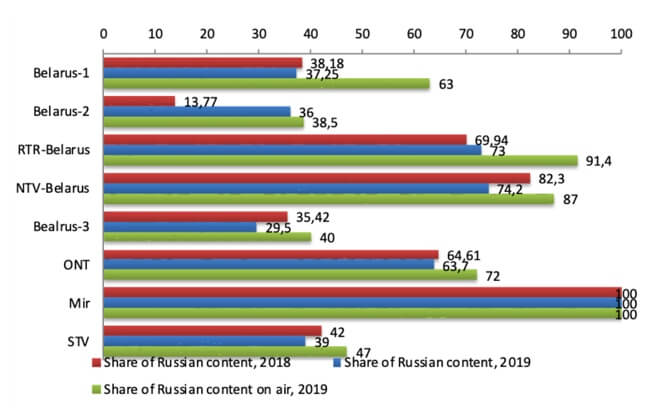

The monitoring5 report “Pro-Russian Propaganda and Coverage of ‘Profound Integration’ on Belarusian Television” by the BAJ generally indicates the effectiveness of extra spending meant to increase the share of national content on Belarusian television (Diagram 2).

Source: Belarusian Association of Journalists.

Compared with 2018, the share of Russian content slightly decreased on Belarus-1 channel (from 38.18% to 37.25%), ONT (from 64.61% to 63.7%), STV (from 42.0% to 39.0%), decreased more on NTV-Belarus (from 82.3% to 74.2%) and Belarus-3 (from 35.42% to 29.5%), and increased on RTR-Belarus (from 69.94% to 73.0%) and grew significantly on Belarus-2 entertainment channel (from 13.77% to 36.0%). Small changes in the share of Russian content on the top television channels indicate (at least in quantitative terms) that increased public spending was ineffective. It may have some larger effect in the future, though, and the situation will probably change in 2020–2021.

At the same time, information pressure on the country is intensifying and taking new forms. According to a study by the EAST Center, until 2018, Russian Regnum and EADaily platforms were used as the main tools of anti-Belarussian propaganda. “Published materials questioned the sovereignty and independence of Belarus and its territorial integrity, contained insulting remarks regarding the Belarusian nation, language and culture.” A whole network of Belarusian regional Internet sites was created in 2018–2019. They regularly posted misinforming and propaganda materials in hateful language against different groups of the population of Belarus. Teleskop-by.org, Sozh.info, Vitbich.org, Berestje-News.org, GrodnoDaily.net, Mogilew.by, Podneprovie-Info.com, Dranik.org were among them.6

These websites reach an insignificant segment of the Belarusian audience, but their very presence can contribute to destabilizing the situation. Belarus’ information policy does not provide an alternative.

Alternative sources of media financing and advertising market

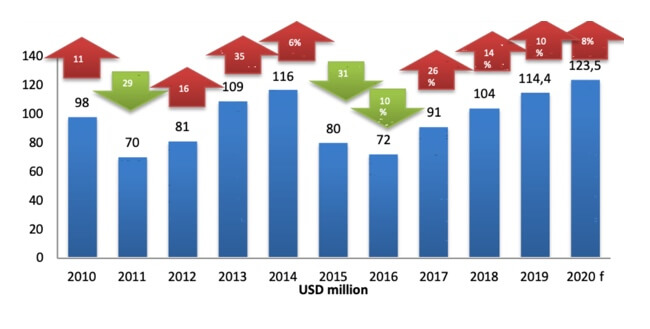

Processes in the advertising market can hardly help strengthen the national media space, although the market grew by 10% in 2019 (Diagram 3). This growth only occurred thanks to online advertising, the share of which exceeded the share of advertising on TV for the first time in the history of the Belarusian advertising market.

Source: WebExpert

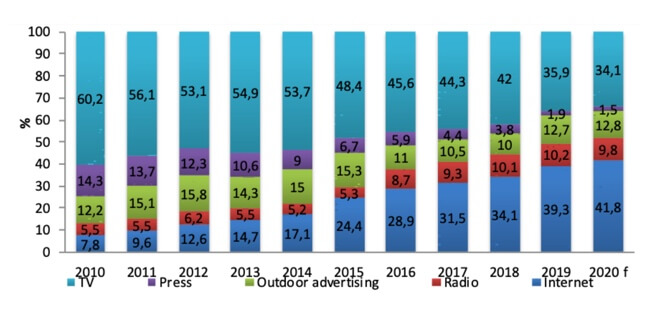

In 2018, the share of TV advertising made up 42.0% against 34.1% of online advertising. In 2019, this ratio was 35.9% against 39.3%, respectively (Diagram 4). Online media advertising thus yields the palm to contextual advertising (37.0% against 63.0%). Targeted advertising in social media is the most common tool. Therefore, growth of the advertising market does not automatically determine growth of investment in the media.

Source: WebExpert

TV Press Outdoor advertising Radio Internet

Beside next-to-zero growth of investments in media from TV advertising, infrastructural peculiarities produce a negative effect on the TV advertising market. Back in 2011, state-owned television channels reported that Growth from Knowledge (GfK, Russia) won the tender for media research in Belarus, but the project was never launched.

Real Measurement LLC took over media research from GEVS in 2018. Data was processed and disseminated by AMG-Consult LLC. In September 2019, the Belarusian State TV and Radio Company, Second National Television Channel CJSC, Stolichnoe Television CJSC, and the Office of Mir TV and Radio Company set up the Television Advertising Alliance sales house on a parity basis and terminated the contract with AMG Consult.

Negotiations with the state sales house on data acquisition took longer than expected. Real Measurement entered into a single source data supply contract with the sales house of Alcazar Media Service private TV channels and had to reduce the sample size and the number of measured channels (ONT, Russia-Belarus, STV and Mir were excluded). The state media are voicing plans to create a state-owned media meter company by the end of 2020.7

This means gradual nationalization of infrastructure for the sale of television advertising in conditions of poor transparency and awareness of market players, which undermines the effectiveness of the system.

In the meantime, changes are also taking place in infrastructure for media research on the Internet. The analysis of the Belarusian Internet audience had been based on data provided by Gemius SA since 2009. Gemius then announced a rise in its fees, so its Belarusian partner #DB3 stopped buying GemiusAudience audience research data, GemiusDirectEffect advertising campaigns audits and gemiusAdHoc quantitative research reports.8 Apparently, Belarusian media will experience a shortage of research data on both traditional and online media.

Conclusion

The year 2019 was relatively calm for the media in Belarus. No significant changes were observed. However, internal and external threats to stability and security of the national information space were increasingly accumulating.

An internal media stability decline took place due to the impaired efficiency of the increasing government funding of state-owned media and the condition of advertising market infrastructure.

External potential threats encompass Russia’s continuing pressure on the national information space and the diversification of sources of this pressure. Since the Belarusian leadership is well aware of the information security problem, 2020 is likely to see targeted measures aimed at the nationalization of advertising infrastructure and the launch of a new news channel. This plan was voiced at the presidential meeting with heads of the leading media outlets on February 11, 2020.

However, the ongoing slowdown in economic growth and disturbance on the advertising market will lead to a shortage of investment in media. As a result, significant strengthening of the national media sector is highly unlikely.