Foreign Exchange Market: In the grip of a deteriorating internal and external environment

Alexander Mukha

Summary

In 2018, net sales of foreign exchange by households on the domestic foreign exchange market of Belarus shrank considerably; cash incomes increased, and population’s savings in foreign exchange decreased. The growth of ruble deposits of individuals continued, which indicates a gradual de-dollarization of households’ bank deposits.

In 2019–2020, the downward pressure on the exchange rate of the Belarusian ruble and the national gold and foreign exchange reserves may increase under the influence of the tax maneuver in the oil sector of Russia. A depreciation of the Belarusian ruble will exacerbate the risks associated with the accumulated foreign debt of residents of Belarus.

Trends:

- Decreased sales of foreign exchange by households;

- Re-estimation of the real effective exchange rate of the Belarusian ruble;

- Pressure on the ruble and the gold and foreign exchange reserves of Belarus caused by the tax maneuver by the Russian Federation;

- The need to raise funds from external sources.

Households reduce sales of foreign exchange as incomes are going up

In 2018, natural persons significantly reduced their net sales of foreign exchange amid an increase in cash incomes and a decline in foreign exchange deposits and unorganized savings of the population. Individuals sold USD 1.115 billion1 on a net basis (including non-cash transactions) against USD 1.759 billion in 2017 (Table 1). For comparison: in 2018, non-residents sold USD 493.7 million on a net basis (USD 313.9 million in 2017), whereas business entities, on the contrary, bought USD 672.4 million (USD 880.0 million in 2017).

| Period | Net demand (–) and net supply (+) of foreign exchange | |||

|---|---|---|---|---|

| Economic entities | Households* | Non-residents** | Total | |

| 2014 | –495.0 | –1385.0 | 261.7 | –1,618.3 |

| 2015 | –403.8 | 129.6 | 227.2 | –47.0 |

| 2016 | –206.1 | 1,894.0 | 452.5 | 2,140.4 |

| 2017 | –880.0 | 1,759.0 | 313.9 | 1,192.9 |

| 2018 | –672.4 | 1,114.8 | 493.7 | 936.1 |

| 1Q19 | 39.7 | 41.3 | 153.4 | 234,5 |

Note: *Including transactions of natural persons on the cash foreign exchange market (including payment media) and non-cash operations. **Including transactions under the Eurasian Economic Union Treaty of May 29, 2014, which regulates the receipt and distribution of import customs duties in the EEU.

Source: Author’s estimates based on data of the National Bank of the Republic of Belarus.

Households’ unorganized savings in foreign exchange declined significantly over the past few years. From 2015 to the 1st quarter of 2019, households sold USD 7.670 billion (on a net basis) previously stashed “under the mattress”. For the most part, these stashes are regularly replenished by money sent home by Belarusians employed outside the country.

The significant drop in sales of foreign exchange by households in the 1st quarter of 2019 is noteworthy: USD 41.3 million (including non-cash transactions) in total against USD 303.4 million in 1Q18.

In 2018, real money incomes of households (factored in by the consumer price index for goods and services) increased 8% from 2017 to BYN 72.89 billion2 (Table 2).

| Period | Money incomes*, BYN mln. | Money incomes in USD equivalent, mln. | % against the previous period | ||

|---|---|---|---|---|---|

| Money incomes | Real disposable money incomes | Money incomes in USD equivalent | |||

| 2013 | 44,228.6 | 49,301.4 | 137.5 | 116.3 | 128.3 |

| 2014 | 52,627.6 | 51,293.0 | 119.0 | 100.9 | 104.0 |

| 2015 | 56,289.1 | 34,631.8 | 107.0 | 94.1 | 67.5 |

| 2016 | 58,705.4 | 29,355.6 | 104.3 | 93.1 | 84.8 |

| 2017 | 64,106.9 | 33,159.3 | 109.2 | 102.8 | 113.0 |

| 2018** | 72,892.1 | 35,727.9 | 113.7 | 108.0 | 107.7 |

Note: *Taking into account the denomination of the Belarusian ruble in July 1, 2016; **Preliminary data

Source: Author’s estimates based on data of the National Statistics Committee and the National Bank of the Republic of Belarus.

According to our calculations, last year, money incomes of households in USD equivalent increased by USD 2.57 billion (7.7%) to USD 35.73 billion. The all-time high (USD 51.29 billion cash) was registered in 2014. The National Bank management was replaced following the local crisis in the foreign exchange market at the end of 2014.

In 2018, the average accrued wage (excluding wages in micro-organizations and small organizations without departmental affiliation) increased 10.3% year-on-year from USD 425.6 to USD 469.6 (Table 3). The average wage in USD equivalent was the highest in 2014 (USD 589.9).

| Period | Nominal wage*, BYN | Wage in USD equivalent | % against the previous period | ||

|---|---|---|---|---|---|

| Nominal wage | Real wage | Wage in USD equivalent | |||

| 2013 | 506.1 | 564.2 | 137.7 | 116.4 | 128.5 |

| 2014 | 605.2 | 589.9 | 119.6 | 101.3 | 104.6 |

| 2015 | 671.5 | 413.1 | 110.9 | 97.7 | 70.0 |

| 2016 | 722.7 | 361.4 | 107.6 | 96.2 | 87.5 |

| 2017 | 822.8 | 425.6 | 113.9 | 107.5 | 117.8 |

| 2018** | 958.1 | 469.6 | 116.4 | 111.6 | 110.3 |

Note: *Taking into account the denomination of the Belarusian ruble in July 1, 2016; **Preliminary data

Source: Author’s estimates based on data of the National Statistics Committee and the National Bank of the Republic of Belarus.

Despite a noticeable increase in cash incomes of households, foreign exchange deposits of natural persons decreased by USD 253.8 million (3.4%) to USD 7.133 billion as of January 1, 2019. Among other things, this was caused by a sharp decrease in the interest rates on deposits in foreign exchange. In 2018, the average rate on new fixed-term foreign exchange deposits of natural persons was only 1% per annum. The rate on revocable deposits was set at 0.7% and the rate on irrevocable deposits was 1.5%. After taxes, the effective values of interest rates are even lower.

Ruble deposits of natural persons increased by BYN 1.237 billion (22.4%) to a record high of BYN 6.768 billion as of January 1, 2019. As a result, the proportion of ruble deposits increased to 30.5% as of January 1, 2019 from 27.5% as of January 1, 2018, which indicates a gradual de-dollarization of deposits of natural persons.

Ruble deposits of households continue to grow despite a noticeable decrease in interest rates. In 2018, the average rate on new fixed-term ruble deposits of natural persons was only 9.1% per annum (5.6% on revocable deposits and 10.0% on irrevocable ones).

In 2018, the spread between the average rates on new fixed-term irrevocable deposits in BYN and foreign exchange was at 8.5 percentage points (pretax).

The pressure on the ruble and foreign exchange reserves will increase

The downward pressure on the exchange rate of the Belarusian ruble and the national gold and foreign exchange reserves is likely to increase in 2019–2020 due to the tax maneuver in the oil industry of the Russian Federation. The maneuver predictably entails slower economic growth, an increased current account balance deficit, problems with public finances, a depreciation of the Belarusian ruble and higher gasoline and diesel prices.

A depreciation of the national currency could also increase the risks associated with the accumulated foreign debt of Belarusian residents (the government, National Bank, banking sector and enterprises). In the report on the Belarusian economy published in January 2019, following the Article IV Consultation,3 the IMF indicated that given the current deficit in the current account balance, the real effective exchange rate of the Belarusian ruble was 10% overvalued against the basket of currencies of Belarus’ main trading partners. A depreciation of the nominal exchange rate of the Belarusian ruble against major foreign currencies may be required (all other things being equal) to adjust the current account balance deficit in Belarus.

| Period | Weight-average BYN rate against* | |||||

|---|---|---|---|---|---|---|

| USD | % against the previous period | EUR | % against the previous period | RUR** | % against the previous period | |

| 2013 | 0.8971 | 107.2 | 1.1834 | 109.8 | 2.7840 | 103.9 |

| 2014 | 1.0260 | 114.4 | 1.3220 | 111.7 | 2.6628 | 95.6 |

| 2015 | 1.6254 | 158.4 | 1.7828 | 134.9 | 2.6237 | 98.5 |

| 2016 | 1.9998 | 123.0 | 2.2010 | 123.5 | 2.9845 | 113.8 |

| 2017 | 1.9333 | 96.7 | 2.1833 | 99.2 | 3.3126 | 111.0 |

| 2018 | 2.0402 | 105.5 | 2.4008 | 110.0 | 3.2417 | 97.9 |

Note: *Taking into account the denomination of the Belarusian ruble in July 1, 2016; **Belarusian rubles for 100 Russian rubles.

Source: Author’s estimates based on data of the National Bank of the Republic of Belarus.

IMF experts warn that a depreciation of the Belarusian ruble may result in worse relative indicators of the external debt of Belarusian residents (including as percentage of GDP due to a fall of the USD equivalent), a decrease in the gold and foreign exchange reserves and higher risks associated with the deteriorating foreign exchange liquidity in the banking sector.

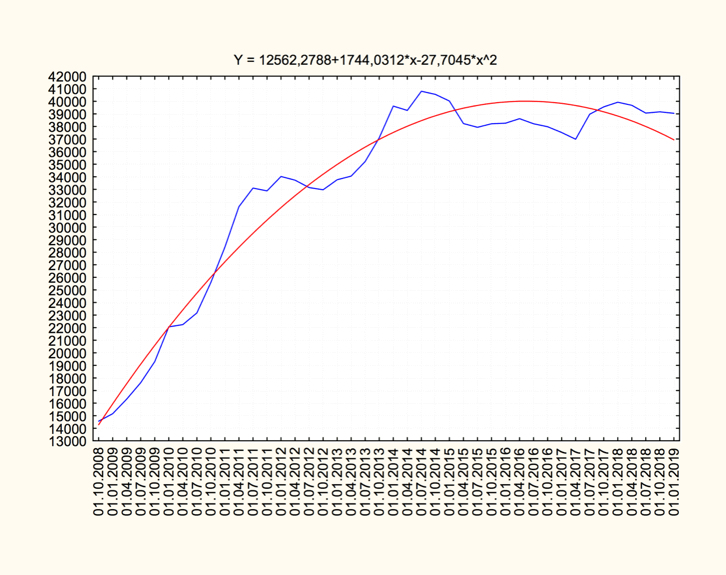

According to the National Bank, in 2018, the total external debt of Belarusian residents decreased by USD 885.5 million (2.2%) to USD 39.04 billion as of January 1, 2019 (Figure 1), i. e. 65.5% of GDP. The relative indicator of the foreign debt of Belarusian residents is still above the economic security threshold (at or below 60% of GDP).

As of January 1, 2019, the upcoming payments on the gross external debt of residents of Belarus include the principal debt and interest totaling USD 46.69 billion.

In 2019, residents’ payments on the external debt are estimated at USD 16.379 billion (including debt refinancing operations). As of January 1, 2019, the gold and foreign exchange reserves of Belarus amounted to USD 7.158 billion, only covering 43.7% of the upcoming external debt payments, although, according to the Guidotti rule, the reserves must cover no less than 100% of upcoming annual payments on the total external debt of country residents.

In general, due to the Russian tax maneuver, the Belarusian government is in need of new external financing. However, the capacity for a further increase in the external public debt through external borrowings looks limited.

Will there be a single currency of the Union State?

Russia might consider compensation for the losses incurred by Belarusian oil refineries due to the tax maneuver in exchange for closer integration within the Union State, and, hypothetically, this may include the launch of a single currency of the two states.

In our opinion, at the present stage, a currency union with a single issuer and a single currency within the Eurasian Economic Union seems preferable, taking into account the experience of the European Union. A single Eurasian currency would have a larger economic potential, including in terms of its internationalization, which provides for the use of a single currency of the EEU in monetary settlements with third countries.

In the current situation, a further expansion of the use of national currencies in foreign economic operations in the EEU coupled with permission for resident legal entities to carry out internal non-cash payments in all national currencies of the EEU member states would be appropriate as intermediate measures towards a single Eurasian currency. This would expedite settlements, reduce the cost of conversion and expand currency risk management capabilities of business entities and banks.

According to the National Bank of Belarus, in the composition of foreign exchange earnings of nonfinancial businesses and households (foreign exchange receipts from the movement of goods, services, incomes and transfers), the proportion of the Russian ruble decreased from 38.4% in 2017 to 34.0% in 2018, and the proportion of the U.S. dollar increased accordingly from 26.1% to 27.5%, the euro from 33.2% to 36.3% and the Belarusian ruble from 1.4% to 1.6%. The proportion of other currencies decreased from 0.9% to 0.7%.

In 2018, Russia paid for 82.4% of imported Belarusian commodities in Russian rubles, 0.9% in Belarusian rubles, 10.8% in U.S. dollars, 5.6% in euros and 0.3% in other currencies.

In absolute terms, foreign exchange earnings in Russian rubles increased by USD 206.3 million (1.5%) to USD 14.1 billion. It should be clarified that a certain part of earnings in Russian rubles is not taken into account in official statistics, since it comes in cash from labor migrants.

In payments for Belarusian goods and services, Russian rubles are used not only by Russian companies, but also by residents of other states. In 2018, Belarus’ earnings in Russian rubles in USD equivalent received from Russia amounted to USD 13.537 billion, USD 259.5 million from other EEU countries, USD 38.9 million from the EU member states, and USD 269.9 million from other countries.

At the same time, in the composition of payments for imported goods, services, incomes and transfers by nonfinancial businesses and households, the proportion of the Russian ruble remained at 47.7%. The proportion of the U.S. dollar decreased from 24.0% in 2017 to 23.5% in 2018, and the proportion of the euro increased accordingly from 26.6% to 27.4%. The proportion of the Belarusian ruble decreased from 0.8% to 0.7%, and the proportion of other currencies decreased from 1.0% to 0.7%.

In 2018, Belarus paid for 79.2% of imported Russian goods in Russian rubles, 0.7% in Belarusian rubles, 10.3% in U.S. dollars, 9.7% in euros and 0.03% in other currencies. In absolute terms, payments by residents of Belarus in Russian rubles increased by USD 2.72 billion (16.5%) to USD 19.195 billion.

As a result, Belarus has a trade deficit when operating with Russian rubles: USD 5.091 billion in equivalent in 2018 against USD 2.579 billion in 2017. To a certain extent, this deficit is covered by unofficial incomes of labor migrants and external borrowings denominated in Russian rubles.

Conclusion

In 2019–2020, net supply of foreign exchange by households is likely to decrease, which may lead to a decrease in the exchange rate of the Belarusian ruble against major foreign currencies.

The Russian tax maneuver and large-scale payments on the external debt of residents of Belarus will cause additional downward pressure on the exchange rate and the national gold and foreign exchange reserves.